Highlights from the latest update of Cedigaz’ Worldwide UGS Database.

Only 25 bcm of working capacity is under construction

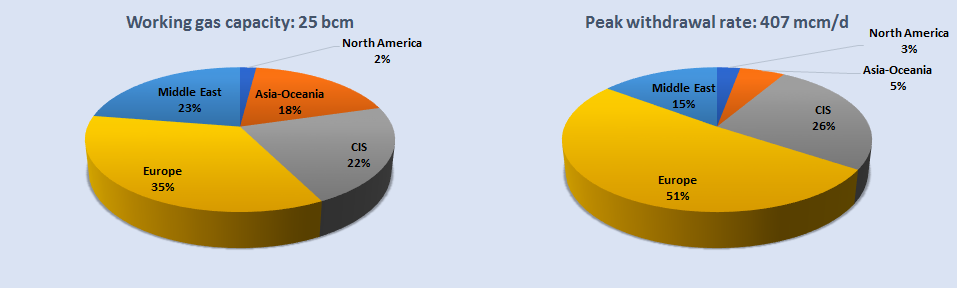

The capacity currently under construction is limited. At worldwide level, there are 48 storage projects[1] under construction adding 25 bcm of working capacity. This includes only 15 new storage sites (12 bcm) and 33 expansions (13 bcm). Again, this is lower than last year’s report (58 projects adding 36 bcm of working capacity) and previous ones. This is partly due to the commissioning of storage facilities in 2016, but also to cancellations of projects. Most of the projects under construction will be completed by 2020/25. All regions, but Central and South America, participate in the additions to storage capacity currently under construction. It is worth noting that Europe ranks first, but capacity under construction is concentrated in Italy, where the storage regulation is much more favorable than in other European countries. The CIS ranks second with expansions and new facilities built in Russia. The Middle East and Asia-Oceania account for 23% and 18% of the world additions. The shift of storage investment to new emerging and growing gas consuming countries started at the beginning of the 2010s and is expected to dominate the next 20 years. The additions to withdrawal capacity are dominated by Europe reflecting the focus towards highly flexible storage in the region.

Figure 6: Storage under construction by region

Source: CEDIGAZ

Source: CEDIGAZ

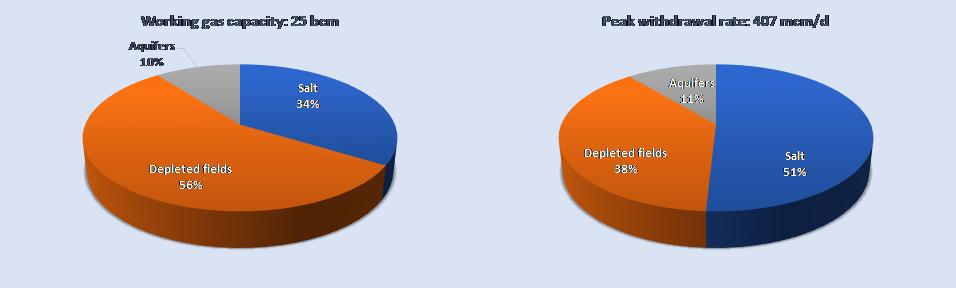

By type of storage, salt caverns projects dominate in mature markets, while all types of UGS are developed in emerging markets. One significant exception is UGS developed in aquifers, which have almost disappeared from the list of new projects (only two UGS under construction). Environmental issues make their construction more difficult and their relative low flexibility makes them less suitable to current market needs in liberalized markets.

Salt caverns projects represent almost half of the total number of projects under construction (22 projects). Most of them are built in Europe, but emerging markets (China, Iran) are also building this type of UGS. The working capacity (8.4 bcm) of salt caverns projects accounts for 34% of the total capacity under construction and their combined withdrawal rate for 51% of the total deliverability.

Figure 7: Storage under construction by type

Source: CEDIGAZ

Source: CEDIGAZ

Identified projects would add 52 bcm, but remain uncertain

At worldwide level, there are 106 identified projects at different stages of planning (planned and potential). If all built, these projects would add 52 bcm of working capacity. Data on working gas capacity are missing for several announced projects in emerging gas countries. Therefore, it is not possible to evaluate the shift of storage activity to emerging gas countries based on identified planned projects.

Conclusion

Overall, there are 154 projects under construction, planned or potential, representing 77 bcm of working capacity. This figure shows the readiness of the storage industry to continue investing in this key asset to support the expansion of the global gas market and accompany the trend towards more intermittent energy sources. However, the figure is much lower than in 2013 when 236 projects totaling 153 bcm of working gas capacity were either under construction or identified. This is due to two factors: in mature markets, numerous projects have been put on hold or even cancelled. In new and growing markets, the storage market is still in its infancy and projects are not identified precisely in several countries.

Figure 8: Storage under construction, planned and potential – Working gas capacity and withdrawal rates

Source: CEDIGAZ

Source: CEDIGAZ

[1] Each phase of a multi-phase storage expansion is considered as one UGS project (when such information is available).

Related: Underground Gas Storage & Lng Storage Market In The World (2015-2035)