In an era marked by fluctuating energy markets and geopolitical tensions, the importance of underground gas storage (UGS) has never been more pronounced. As the backbone of global gas security, UGS facilities play a critical role in balancing supply and demand, mitigating price volatility, and ensuring a stable energy supply during peak consumption periods. The recent global gas crisis has thrust UGS into the spotlight, prompting accelerated growth and renewed investment in this vital infrastructure.

Accelerated Growth of Underground Gas Storage

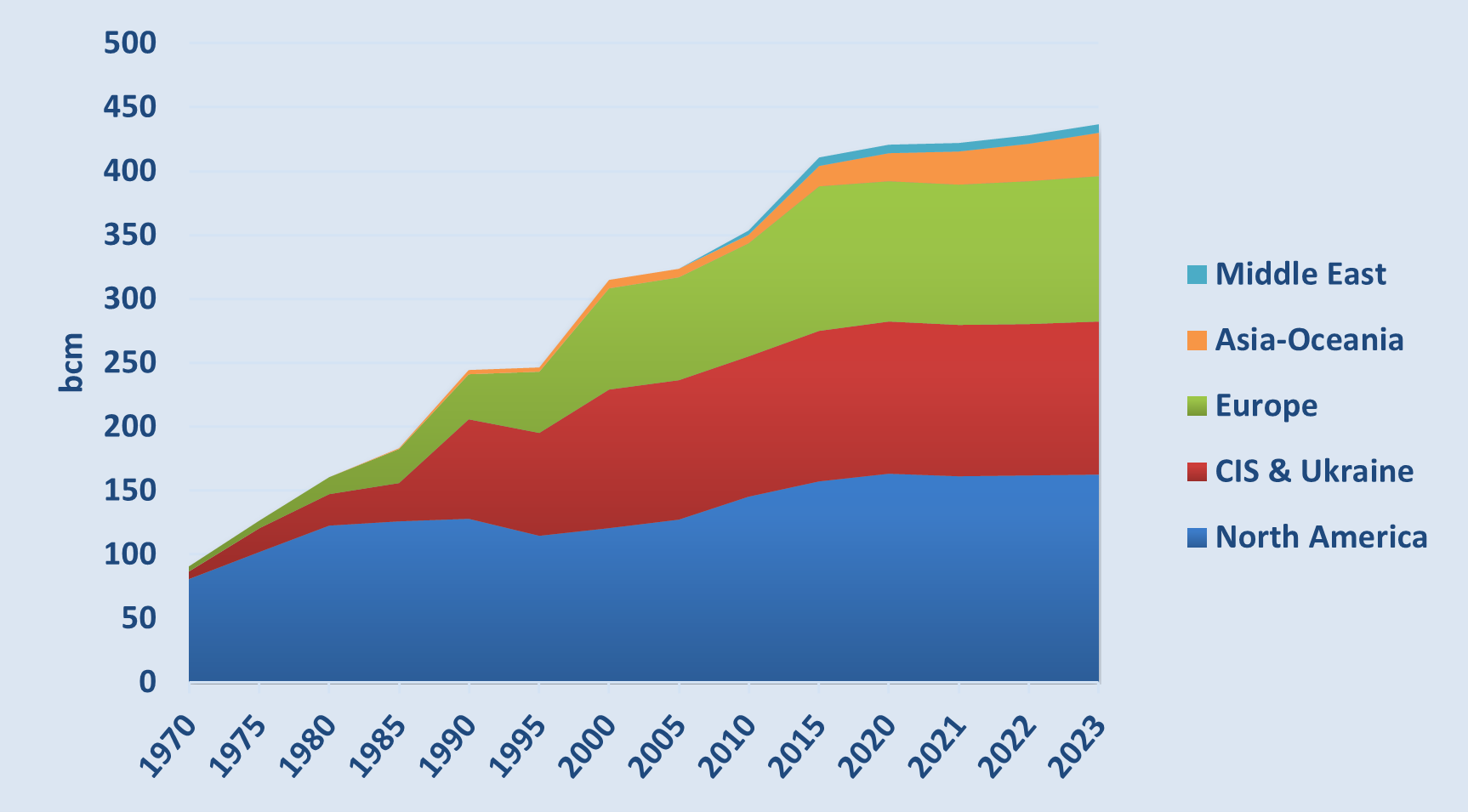

By the end of 2023, the global working gas capacity of UGS reached 437 billion cubic meters (bcm), a 2% year-on-year increase—the largest since 2015. This surge is primarily due to significant capacity expansions in China, with additional contributions from Europe, Kazakhstan, and Canada. The number of operational UGS facilities globally stood at 681, with China commissioning five new facilities and Saudi Arabia adding its first. The global peak withdrawal rate also increased by 1.6% to 7,516 million cubic meters per day (mcm/d).

Evolution of Global Working Gas Capacity (2023-2024)

Source: CEDIGAZ – Country indicators database, UGS database

The UGS market is dominated by a few countries, with the top five—the United States, Russia, Ukraine, Canada, and China—holding 68% of worldwide capacities China’s rise to the fifth position, overtaking Germany, reflects its rapidly expanding gas market. This highlights a shift towards rapidly growing gas markets in China and the Middle East. Depleted fields account for 81% of global working gas volumes, but salt caverns, while only 8% of capacity, provide 25% of global deliverability, crucial for meeting short-term demand fluctuations.

Projected Increase to 500 bcm by 2030

Driven by security concerns and changing market dynamics, UGS working gas capacity is projected to reach 500 bcm by 2030. Currently, 76 storage projects totaling 61 bcm are under construction worldwide, with China alone accounting for over half (34 bcm) of this expansion. New entrants like Brazil are building their first UGS facilities, and countries such as India, Mexico, and Turkmenistan have announced plans to develop theirs. Additionally, 117 projects in various planning stages could add another 112 bcm, a significant leap from the 90 bcm identified at the end of 2022. These developments indicate the industry’s readiness to invest in UGS to support gas market expansion, flexibility, and security.

LNG and Storage Central to Energy Policies

The global energy crisis has prompted governments to prioritize natural gas supply security and market stability. Measures include stricter natural gas storage regulations and the formulation of strategic storage policies, encompassing both UGS and liquefied natural gas (LNG) reserves. In 2023, policies expanded to involve joint or centralized LNG procurement. As a result, gas storage levels ahead of winter 2024/25 are nearly full and exceed five-year averages in all major gas markets, mirroring the preparedness before the previous winter.

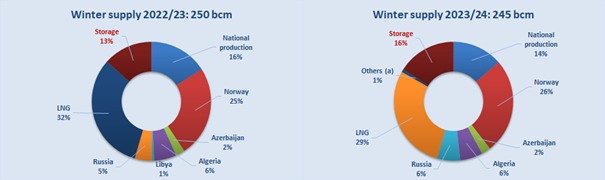

Changing Market Dynamics Impacting UGS Trends

The crisis triggered by Russia’s invasion of Ukraine has led to profound changes in the global gas market. The loss of Russian pipeline deliveries enhanced LNG’s role in supplying and balancing markets. LNG now accounts for more than half of global gas trade, with its importance rising amid energy security concerns. For Europe, LNG has transitioned from a marginal supplier to a baseload source, with U.S. flexible LNG supplies taking the lion’s share of incremental deliveries. In winter 2023/24, LNG accounted for 29% of European total supplies, while UGS provided 16%; the share of Russian gas pipeline deliveries was only 6%.

European winter supply (winter 2022/23 and winter 2023/24)

Source: CEDIGAZ from ENTSOG’s data

Despite upcoming increases in LNG export capacity in 2025, the market may remain tight due to rising demand in Asia and Europe. Significant relief is expected starting in 2026 when large LNG export capacities from the U.S. and Qatar come online. The shift of UGS capacity growth towards high-demand centers like China and the Middle East is now a structural driver of the global UGS market. The enhanced role of LNG and increased price volatility underscore the need for flexible gas storage, making UGS more crucial for both producers and importers.

Regional Highlights

Europe:

With stocks sitting at 101 bcm, 95% full and 5% above than their five-year average, on November 1st, 2024, Europe appears well prepared for the winter although uncertainties remain (weather, geopolitical events, Asian demand…).

Ukraine:

Filled its UGS to 12.9 bcm by November 2024 but faces risks due to infrastructure attacks, leading to reluctance from foreign traders to utilize its storage facilities.

Russia:

Is developing UGS facilities in the Far East to support its pivot towards Asian markets.

United States:

Is witnessing a revival of UGS in salt caverns along the Gulf Coast, with capacity expected to increase by 26% by 2030/31.

China:

Increased its UGS capacity by 83% over three years, reaching 26.6 bcm by the end of 2023, and is on track to meet its 55–60 bcm target for UGS and LNG storage by 2025.

Central and South America, Mexico:

Advancing UGS projects to reduce reliance on costly spot LNG purchases during peak demand periods.

Middle East:

Expanding storage capacity to meet surging gas demand, with Saudi Arabia commissioning its first UGS facility in 2023.

Conclusion

The accelerated growth of UGS underscores its critical role in ensuring energy security amid global market uncertainties. With significant investments and strategic policies focusing on both UGS and LNG, countries worldwide are enhancing their ability to manage supply disruptions, price volatility, and the transition towards cleaner energy systems. The projected increase to 500 bcm by 2030 reflects a collective commitment to bolstering the flexibility and resilience of global gas markets.

More in the report :

UNDERGROUND GAS STORAGE IN THE WORLD – 2024 STATUS

By Sylvie Cornot-Gandolphe, Consultant on Energy Markets and Raw Materials, for CEDIGAZ

November 2024 – 69 pages PDF format