LNG market report: 3rd Quarter 2023 and Gas Year 2022-2023

The 2022-2023 Gas Year that ended on September 30, showed a continuation of the main trends that emerged in 2021-2022. These developments are detailed in the latest CEDIGAZ LNG market report.

Key facts:

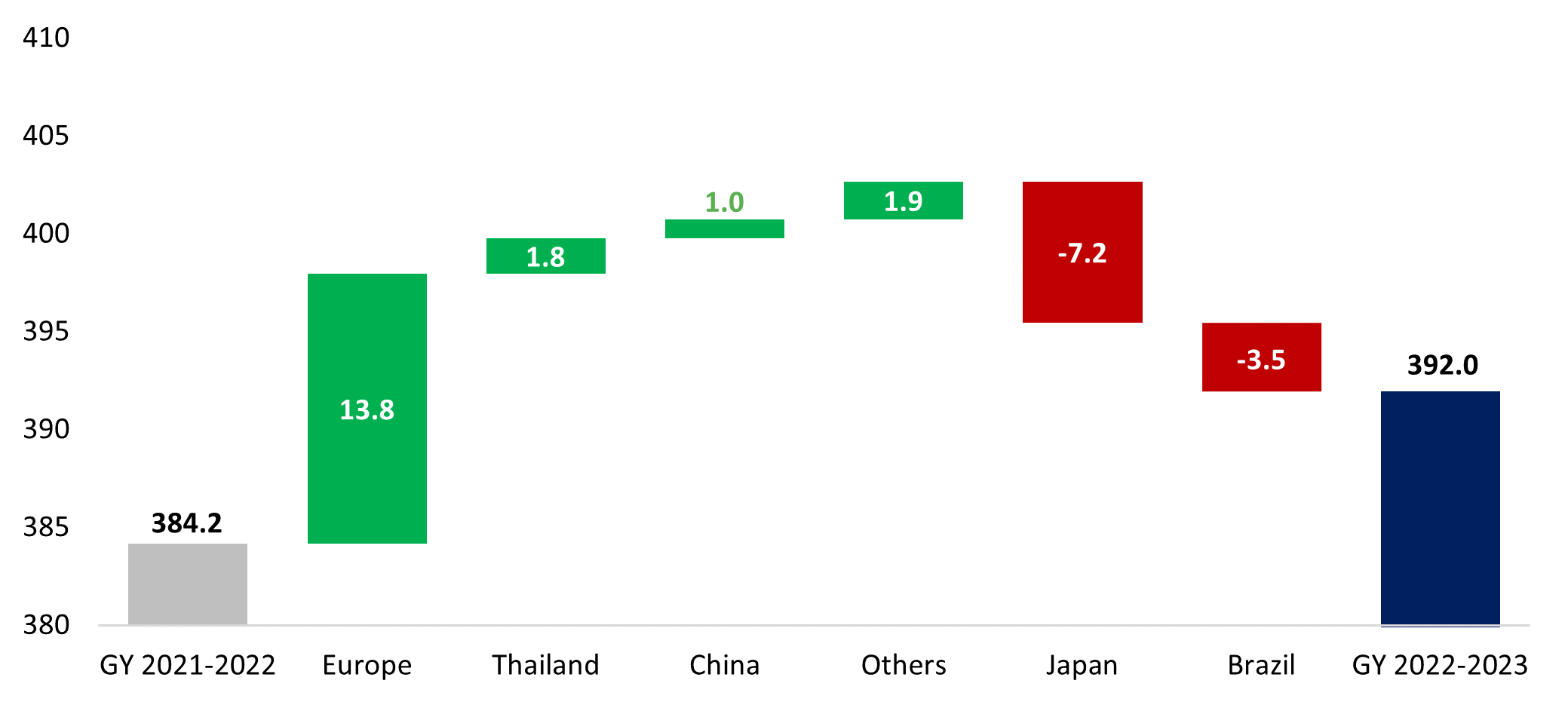

- Europe’s Demand Growth: In GY 2022-23 Europe remained the key LNG demand growth region, importing 123 million tonnes (mt), an increase of 14 mt (13%) from GY 2021-22, and a significant rise of 54 mt compared to 70 mt in GY 2020-21

- Decline in Japan and China’s Imports: The two largest LNG importing countries, Japan and China, saw a combined decrease of ~20 mt in imports over the past two gas years, with each country reducing imports by about 10 mt from GY 2020-21 to GY 2022-23 (Chinese demand slightly increased in GY 2022-2023)

- Thailand’s Growing Market: Thailand emerged as a key growth market in Asia for the second consecutive gas year, increasing its imports by 1.8 mt from GY 2021-22 to GY 2022-23, following a 2.7 mt increase in the previous gas year

Key changes in global LNG imports (GY 2022-23 vs. GY 2021-22), mt

Source: CEDIGAZ

- Shift in US LNG Destination Markets: The share of Europe in total US LNG export volumes continued to rise in GY 2022-23, reaching 68% (up from 61% in GY 2021-22 and 29% in GY 2020-21). Europe’s dependence on US LNG also hit a new record of 45% in GY 2022-23

- Contrasting Trends in African LNG Production: African LNG producers had mixed results in GY 2022-23. Mozambique and Algeria, combined, increased their supplies by 3.9 mt, while Nigeria and Egypt, combined, saw a decrease of 3.7 mt

Interested in a deeper dive into the LNG market trends of 2022-2023? Download our full report for comprehensive insights and detailed analyses.