China adopted a new gas storage policy in 2018, mandating minimum stock levels for market participants. The government requires gas suppliers, urban gas distributors, and local governments to have storage capacity equal to 10%, 5%, and 3 days of their annual sales/demand. In 2021, the government issued an implementation plan to accelerate the construction of storage capacity (both underground gas storage (UGS) and liquefied natural gas (LNG) reserves). The plan requires that the total gas storage capacity reaches 55 billion cubic meters (bcm) to 60 bcm in 2025, representing around 13% of the expected natural gas demand. In addition, since the global energy crisis, the new watchword has been to “store as much as possible”. These policies have triggered massive development in gas storage, both in UGS and LNG storage tanks.

The acceleration of the construction of UGS has enabled China to increase its UGS working gas capacity by 83% in just 3 years, from 14.5 bcm at the end of 2020 to 26.6 bcm at the end of 2023. China has built 35 UGS facilities/clusters as of end 2023. China accounts for 6% of global UGS capacity and is now ahead of Germany, the country with the largest UGS capacity in Europe. China’s working gas capacity is estimated at 34 bcm at the end of 2024, with more than 7 bcm added during the year, the largest ever in the country.

Despite these significant achievements, China’s UGS working gas capacity still accounts for only 6.7% of 2023 natural gas consumption, far lower than the world average of 10.8%, and the 26% average in Europe. The acceleration of the construction of UGS facilities in China will continue going forward driven by the expansion of the gas market and security of supply concerns. Our database[1] includes 36 UGS projects (19 new facilities and 17 expansions) under construction at the end of 2023, that will enter operation between 2024 and 2028, totalling 34 bcm of working gas capacity. In addition, 17 planned projects (of which 10 new facilities), with a total working gas capacity of 31 bcm could be built in the 2025-2035 period. China’s long-term plan to establish six major gas storage centres across the country is taking shape. Combined, these storage groups will have a working gas capacity of 80 bcm to 100 bcm.

To complement UGS — which remains the pillar of the storage policy — China has accelerated the construction of coastal LNG storage and LNG peak-shaving terminals to enhance the resilience and stability of natural gas supply. With 119 LNG storage tanks, the LNG storage capacity at the 29 receiving terminals operating in China at the end of 2023 totalled the equivalent of 11.2 bcm. The growth was spectacular in 2023. China added 22 LNG tanks with a storage capacity of almost 3 bm gas-equivalent, accounting for 67% of the global capacity addition.

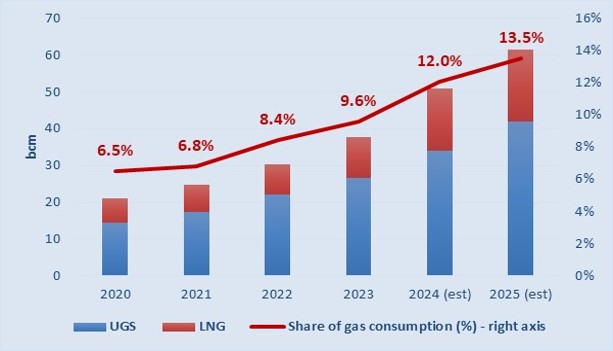

Altogether, the storage capacity of UGS and LNG tanks totalled 37.8 bcm at the end of 2023, accounting for 9.6% of 2023 gas consumption. This is a significant increase (+25%) from the 30.3-bcm recorded at the end of 2022. A total storage capacity of almost 51 bcm is expected to be available at the end of 2024, accounting for 12% of 2024 gas consumption. With the acceleration of the construction of storage capacity, China is going to reach, or even exceed, the target of 55-60 bcm of total storage capacity by the end of 2025, established by the National Energy Administration in 2021. The total storage capacity is expected to reach 61 bcm at the end of 2025, accounting for 13.5% of the estimated 2025 gas consumption.

UGS and LNG storage capacity in China (2020-2025)

Source: CEDIGAZ

The acceleration of the storage build-out is bearing fruits. China starts the heating season 2024/25 with confidence. UGS has now become a key tool in ensuring security and stability of gas supplies during the heating season. Storage enables China to optimize its LNG purchases and reduce the overall cost of gas imports. Combined with its large and diversified portfolio of long-term LNG contracts, it also enabled China to play an active role in managing the global gas crisis.

[1] CEDIGAZ’s comprehensive online database includes detailed statistical information on current and future capacities for the 681 UGS facilities in operation in the world and the 193 UGS projects under construction, planned or potential. The database is available to CEDIGAZ’s members under the infrastructure section of CEDIGAZ website.

More in the report :

UNDERGROUND GAS STORAGE IN THE WORLD – 2024 STATUS

By Sylvie Cornot-Gandolphe, Consultant on Energy Markets and Raw Materials, for CEDIGAZ

November 2024 – 69 pages PDF format