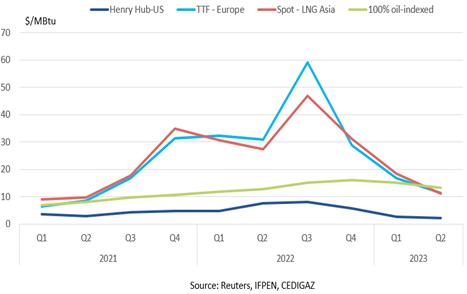

In the second quarter of 2023, European and Asian spot prices continued to fall sharply in a context of weak demand and high inventories in the three major consumer markets (Europe, Asia and North America). In the second quarter of 2023, European and Asian spot prices were on average 60% lower than in the second quarter of 2022 but remained historically high. Improving gas supply-demand balances have resulted in a relatively abundant supply of LNG on the international market and high stock levels, particularly in Europe. As a result, the markets are not currently anticipating any major supply tensions in the short term. However, this view may change depending on weather conditions, which remain the main factor of risk and uncertainty.

Evolution of international natural gas prices in the second quarter of 2023

European and Asian spot prices continued to fall in the second quarter of 2023, to average $11.3/MBtu (€35.4/MWh) and $11.1/MBtu respectively, compared with $16.8/MBtu (€53.5/MWh) and $18.3/MBtu in the previous quarter. They are the lowest since the second quarter of 2021 but remain twice as high as the historical average.

Figure 1: Average quarterly international natural gas prices

For several months now, three factors have been weighing heavily on gas prices in Europe: a sharp reduction in consumption, high stock levels and the growth in LNG imports. According to Cedigaz, gas consumption in the EU fell by 16% in the second quarter of 2023 compared with the historical average. Gas consumption in the industrial sector was the hardest hit, against a backdrop of high prices and economic slowdown. As a result, gas supply has remained abundant in Europe, and stocks are around 80% full at 82 bcm, which is 30% higher than the 2017-2021 average.

There is almost perfect convergence between European and Asian spot prices. As LNG has replaced Russian pipeline gas in Europe, the European gas balance is now heavily dependent on global LNG market conditions, and therefore on Asian LNG demand. As this latter remained moderate and LNG stocks (in Japan) high, the Asian LNG spot price has followed the downward trend in European prices.

The average Japan LNG price, which is mostly oil-indexed, fell by 25 % from 17.1$/MBtu in the first quarter to an estimated 12.8$/MBtu in the second quarter, in response to the fall of the oil-indexed price since 0ctober 2022.

The US spot price also continued its downward trend during the first half of this year. In the second quarter of 2023, it fell by 19% compared with the previous quarter, down to its lowest level since September 2020. This trend reflects a domestic oversupply. Sustained domestic production in the face of moderate demand has allowed stocks to be filled to higher-than-normal levels.

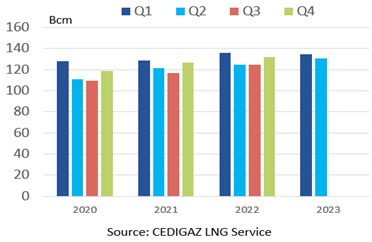

Evolution of international LNG trade

According to Cedigaz, global LNG supply was up by 4.5% in the second quarter of 2023 compared with 2022 for this period of the year, driven by the United States, and, to a lesser extent, Qatar and Australia. The United States was the largest LNG exporter.

Europe (EU and UK) continued to increase its LNG imports. These amounted to 40 Gm3 in the second quarter, which is 7% and 47% higher respectively than in 2022 and 2021 for the same period of the year.

One of the major events of the second quarter of 2023 was the resumption of LNG demand growth in Asia driven by an acceleration of the recovery in LNG demand in China, where imports jumped by 27% compared with 2022 for the same quarter.

Figure 2: Quarterly evolution of International LNG supply

In June, the price arbitrage was more favourable for Asia than for Europe and there was a redirection of cargoes from Europe to Asia. Spot LNG has become more competitive and attractive than oil-indexed long-term-contracted purchases in Asia, increasing competition in the global LNG market between Europe and Asia.

Outlook 2023

According to the forward curves as of 7 July, the European TTF spot price is estimated at €43/MWh in 2023 (compared with an estimate of €37.5/MWh a month ago), which is 65% lower than in 2022, but still well above the 2017-2021 average of €22/MWh.

High gas stocks in Europe and low demand could ease markets this summer notably if supply conditions from Norway improve. In the first half of 2023, the reduction in EU gas consumption was estimated at – 16% compared with the historical average, which is in line with the first quarter and with European targets. Furthermore, at normal injection rates, stocks could be full in September.

The “summer/winter contango” remains high, at around €20/MWh, illustrating the winter risk premium. This reflects anticipated tensions on the global LNG market in the event of an increase in demand in Europe and Asia. Weather conditions will have the greatest impact on demand in the second half of the year. Developments in economic and industrial activity are also a major factor of uncertainty impacting gas markets.

Armelle Lecarpentier, Chief Economist, CEDIGAZ

Contact us: contact@cedigaz.org

Cedigaz (International Center for Gas Information) is an international association with members all over the world, created in 1961 by a group of international gas companies and IFP Energies nouvelles (IFPEN). CEDIGAZ collects and analyses worldwide economic information on natural and renewable gases in an exhaustive and critical way.