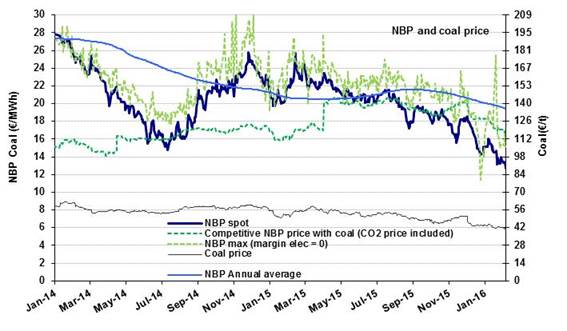

NBP: going down

The NBP fell from €22/MWh ($7/MBtu) in March 2015 to €14.5/MWh ($4.6/MBtu) in January 2016, which represents a decline of 35%. This decrease is consistent with the general trend in energy prices over the same period: coal was down by 25%, oil by 45% and the average price of Japanese LNG by 35%.

The NBP fell from €22/MWh ($7/MBtu) in March 2015 to €14.5/MWh ($4.6/MBtu) in January 2016, which represents a decline of 35%. This decrease is consistent with the general trend in energy prices over the same period: coal was down by 25%, oil by 45% and the average price of Japanese LNG by 35%.

The NBP stood at about €13.2/MWh ($4.2/MBtu) at the beginning of February and is expected to keep sliding. The futures markets anticipate a price of €12.2-12.4/MWh ($4.0-4.1/MBtu) for next summer. These forecasts are in line not only with the decrease in the average six-month oil price, which will also hit bottom next summer, but also with expected coal price trends. The average NBP for 2016 is now pegged at €13.2/MWh ($4.3/MBtu), i.e. 34% lower than in 2015.

The price decreases observed are due to the plentiful supply on the markets. On the oil market, Iran’s gradual return has a downward effect on the oil price. On the LNG market, the latest forecasts by Japan’s IEEJ indicate that consumption may fall 6% in 2016, after slipping 4% in 2015. This is due to the restart of nuclear power production and to the fact that renewable energies are gaining ground. The impact on LNG imports is fairly sizeable: estimated volumes stand at 78 Mt as opposed to 85 Mt in 2015 and around 88 Mt from 2012 to 2014.

Indexed European prices: still falling

In January, the indicative European price (LT 77%) stood at €15.7/MWh ($5.0/MBtu), down by 9% in a month and by 32% in a year. The LT price could continue to descend and reach €12.4/MWh ($4.1/MBtu) by next July, if current trends persist, especially for the Brent, now quoting at $36/b for 2016 compared to $47/b at the beginning of December. Various factors are weighing on this market, including the magnitude of the drop-off in U.S. production, the level of Iranian exports, the increase in demand and the U.S. dollar exchange rate. The latter has recently weakened due to uncertainties relative to the U.S. economy, a factor that usually tends to push the oil price up.

In January, the indicative European price (LT 77%) stood at €15.7/MWh ($5.0/MBtu), down by 9% in a month and by 32% in a year. The LT price could continue to descend and reach €12.4/MWh ($4.1/MBtu) by next July, if current trends persist, especially for the Brent, now quoting at $36/b for 2016 compared to $47/b at the beginning of December. Various factors are weighing on this market, including the magnitude of the drop-off in U.S. production, the level of Iranian exports, the increase in demand and the U.S. dollar exchange rate. The latter has recently weakened due to uncertainties relative to the U.S. economy, a factor that usually tends to push the oil price up.

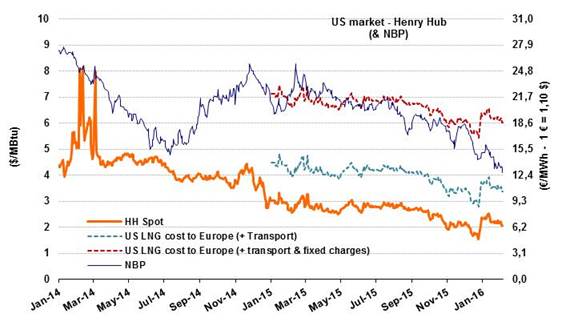

The U.S. market (Henry Hub): up in January, but prices remain quite low

The Henry Hub averaged $2.3/MBtu in January (+17%). The price forecast for 2016 has once again been revised downward to $2.3/MBtu, compared to $2.5/MBtu a month ago. One reason is that the level of stocks is high, standing 15% above the five-year average. Another is that supply is expected to remain stable (current estimate for 2016: +0.5%) in spite of a low rig count (66% lower than at year-end 2014).

The Henry Hub averaged $2.3/MBtu in January (+17%). The price forecast for 2016 has once again been revised downward to $2.3/MBtu, compared to $2.5/MBtu a month ago. One reason is that the level of stocks is high, standing 15% above the five-year average. Another is that supply is expected to remain stable (current estimate for 2016: +0.5%) in spite of a low rig count (66% lower than at year-end 2014).