The last 14 months since the Cedigaz long-term-contracts database (1) was last updated has shown a continuation of the wave of renegotiations that has gained momentum since 2010, recently culminating with the announcement by ENI of its agreement with Gazprom. The deal, which reduces both the price and take-or-pay obligation of contracted gas, has been hailed by the gas community has signaling a move away from oil-indexation by the Russian gas giant. Based on ENI’s declarations some analysts contend that the gas is now 100% hub indexed. According to Argus Media, the actual arrangement is more subtle, the pricing formula would still be oil-based but would include a price corridor based on TTF prices. This looks like an astute solution to Gazprom’s dilemma of sticking to oil-indexation while maintaining its market share. This pricing equivalent of a Platypus would deliver market-linked prices to ENI while allowing Gazprom to maintain its commitment to oil-indexation. It marks the latest development of continuous efforts by Gazprom’s customers to adjust their procurement costs to the market price. Although Gazprom has never endorsed hub pricing – except for a brief period of time in 2010 when a limited amount of spot indexation was included in E.ON, GDF and Wingas contracts – arbitral decisions or negotiated agreements had resulted in a series of adjustments in oil-indexed formulas, with a retroactive effect, reflecting so-called “changing market conditions”. In effect these contractual evolutions, whether negotiated or imposed have resulted in a loose, uncertain and late, alignment of the price of long-term contracts with that of gas markets. The recent Gazprom-ENI pricing formula will certainly prove to be a more practical solution.

Over the last year and a half, negotiations of Gazprom contracts (or arbitration decisions) representing a volume of at least 60 bcm/yr (one third of the volume of Gazprom contracts listed in the Cedigaz database) have been reported. The result has been a decrease in prices, with price discounts in the range of 10-20% often accompanied by a reduction of TOP obligations. Gazprom was not the sole provider to face tough renegotiations of its long-term contracts. Last April, Statoil reached an agreement with ENI, putting an end to the arbitration proceedings initiated by the Italian. This was the last of Statoil’s substantial contracts (6 bcm/yr) still entirely oil-indexed and it is now believed to include at least partial gas-on-gas indexation. The move towards more hub pricing in long-term contracts usually comes at the expense of flexibility of supply, as in many cases, deliverability of flexibility as been curtailed in exchanged for spot indexation.

Over the last year and a half, negotiations of Gazprom contracts (or arbitration decisions) representing a volume of at least 60 bcm/yr (one third of the volume of Gazprom contracts listed in the Cedigaz database) have been reported. The result has been a decrease in prices, with price discounts in the range of 10-20% often accompanied by a reduction of TOP obligations. Gazprom was not the sole provider to face tough renegotiations of its long-term contracts. Last April, Statoil reached an agreement with ENI, putting an end to the arbitration proceedings initiated by the Italian. This was the last of Statoil’s substantial contracts (6 bcm/yr) still entirely oil-indexed and it is now believed to include at least partial gas-on-gas indexation. The move towards more hub pricing in long-term contracts usually comes at the expense of flexibility of supply, as in many cases, deliverability of flexibility as been curtailed in exchanged for spot indexation.

Geoffroy Hureau – Secretary General of Cedigaz

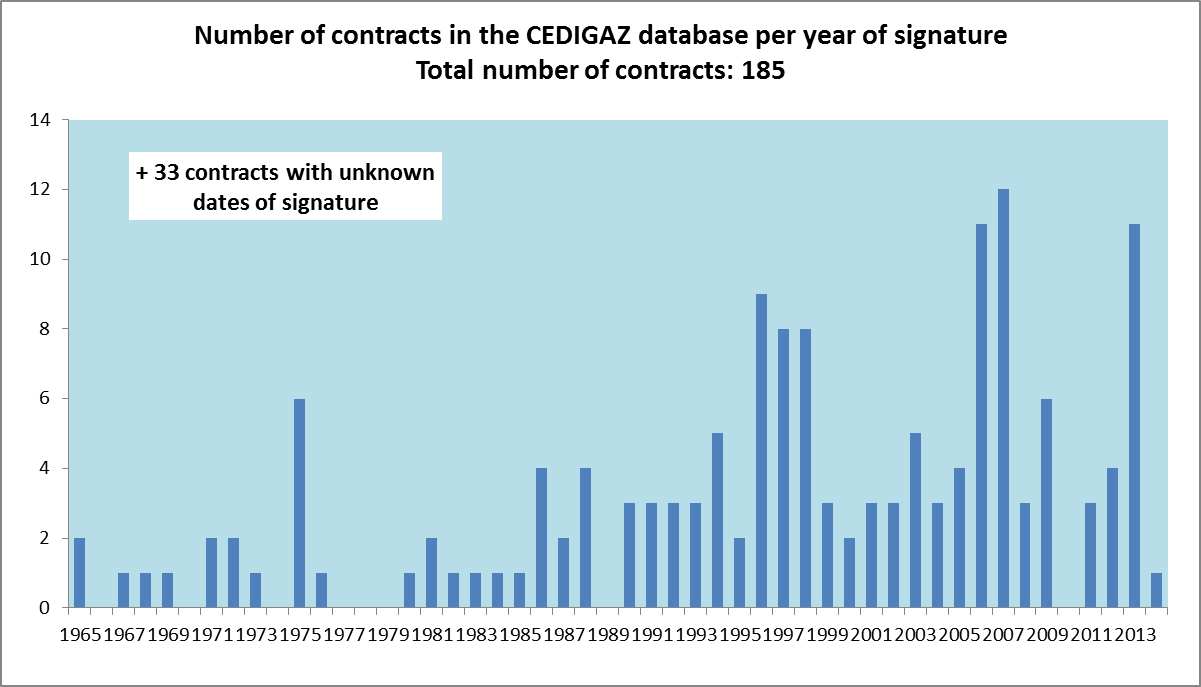

(1) New contracts representing 11.4 bcm/yr have been identified by Cedigaz and added to the database, including the nine contracts signed between the BP-led Shah Deniz consortium and European buyers last September, totaling 10 bcm/yr of gas from the second phase of the Azeri field. The gas will be transported through the TAP pipeline from 2019 if the project is delivered on time.