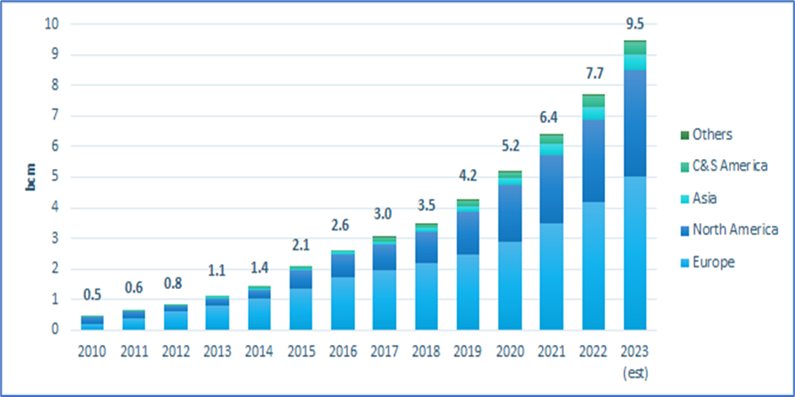

CEDIGAZ has just published its 2024 annual report on the global biomethane market which focuses on recent trends in global and regional biomethane markets in 2023. According to CEDIGAZ, global biomethane production expanded to 7.7 billion cubic metres (bcm) in 2022, a growth of 20% compared to 2021, driven by Europe and North America. It is estimated at 9.5 bcm in 2023, an increase of 23%. Driven by strong structural policy and market drivers, the biomethane market is poised for a huge expansion over this decade and beyond. The targets announced by regional and national governments around the world exceed 100 bcm/y by 2030. Reaching this ambitious level requires the adoption of the right policy and regulatory framework, an acceleration of support, and faster permitting, which many governments have put in place in 2023.

In 2023, biomethane has made further progress towards mainstream adoption by governments, end-users and the capital market transforming from a niche to a key renewable energy sector. On the policy side, the three main drivers of the adoption of biomethane – decarbonization, methane emissions reductions and security of supply – are driving enabling policies and investments, leading to massive growth in the sector. On the market side, over years, biomethane has been used by a widening group of consumers across sectors and all over the world. Cities, major corporations, industrial users in hard-to-abate sectors, fleet owners and gas/energy utilities have adopted biomethane to move towards a circular economy, respond to the need of their customers for low-carbon products/supplies, rapidly decarbonize hard-to-abate sectors, and meet their environmental, social, and governance (ESG) commitments and reporting requirements. The first long-term large-scale deals for unsubsidized biomethane were signed in 2023, opening a huge market opportunity for biomethane going forward.

In this context, 2023 was again a compelling year for financial transactions in the sector. In the challenging environment of 2023, where financial transaction activity in renewables (all technologies) declined in volume, biomethane was a notable exception. The sector is constantly innovating to adapt its technologies to new market needs (e.g. bio-CO2, bio-LNG, biohydrogen), commercialize innovative technologies to treat a variety of feedstocks (e.g. gasification), deploy modular designs for faster builds, and achieve cost reductions by scaling up production to benefit from economies of scale and by industrializing the sector.

Global biomethane production expanded to 7.7 billion cubic metres (bcm) in 2022, a growth of 20% compared to 2021, driven by Europe and North America. It is estimated at 9.5 bcm in 2023, an increase of 23%. These increases will seem modest when the investments decided in 2022/2023 materialize. The time necessary to get permits (at least 2 years) and build new facilities (18 months) means that the new wave of biomethane plants decided in the wake of the 2022 energy crisis in Europe and the passage of the IRA in the US will be seen starting in 2025/26.

Current production is concentrated in Europe and North America. European production grew almost 20% to 4.2 bcm in 2022 (3.4 bcm in the EU), driven by growth in France, Denmark, Italy and the UK mainly. Production is estimated at 5 bcm in 2023 (+ 19% year-on-year). Biomethane represented only 1% of EU gas demand in 2022, but in some countries this share has already reached 30% to 40%. In North America, the US has reinforced its leading position, accounting for almost a third of global production. US biomethane production increased to 2.5 bcm in 2022 from 275 facilities and is expected to exceed 3 bcm in 2023. The sector is propelled to new heights by the IRA.

In addition, Brazil, China and India produce small quantities of biomethane today but present a tremendous growth potential, while several countries in Asia and Central and South America initiated biomethane production in 2023.

The use of biomethane in the transportation sector has surged and accounted for 57% of the growth in global biomethane demand in 2022, boosted by growing demand by large fleet owners and emerging demand in marine transportation. The transport sector accounted for 45% of global biomethane demand.

Driven by strong structural policy and market drivers, the biomethane market is poised for a huge expansion over this decade and beyond. Based on announced national and regional biomethane production targets, the global biomethane market could reach as much as 117 bcm by 2030, with the largest growths expected in North America, the EU, Brazil, China and India. This represents a CAGR of almost 40% over the decade. In Europe, since the publication of the REPowerEU plan, the biomethane industry, policy makers and stakeholders have intensified their efforts and significant progress has been made towards achieving the 35-bcm target. Cross-border trade is rising and is expected to become a key driver of the growth in biomethane production. While achieving the European Commission (EC) target is feasible, national policy makers must affirm clear political support to the sector, promote investment with effective incentives, and expedite authorization processes. Critical initiatives include catalysing biomethane demand, more ambitious NECPs targets, harmonization and simplification of European rules, and development of innovative technologies.

Figure 1: Evolution of global biomethane production (2010-2023)

Source: SCG Consulting/CEDIGAZ

Sylvie Cornot-Gandolphe for CEDIGAZ

May 2024 – 87 pages PDF format

For more information: contact@cedigaz.org

https://www.cedigaz.org/

Cedigaz (International Information Center on Natural and Renewable Gases) is an international association with members all over the world, created in 1961 by a group of international gas companies and IFP Energies nouvelles (IFPEN). Dedicated to natural and renewable gas information, CEDIGAZ collects and analyses worldwide economic information on natural gas, LNG and low-carbon gases in an exhaustive and critical way.