Natural gas consumption grew 1.6% to 3528 bcm in 2016, according to CEDIGAZ, driven by multiple structural and temporary factors. This positive growth is similar to the previous year’s and also in line with Cedigaz short and medium-term natural gas demand forecasts.

These recent developments in natural gas demand illustrate the influence of mixed drivers. More affordable natural gas prices in 2016 have given a boost to natural gas and LNG demand in both industrialized (Europe) and emerging markets. In addition, colder than usual temperatures in the final months of 2016 in the main consuming markets had a strong upward effect on domestic gas sales. Reversely, moderate global economic activity, the decline in energy intensity, weak electricity demand in OECD markets and the strong expansion of renewables are still weakening gas demand growth. If we set climate effects aside, it can be noted that the expansion of natural gas demand has remained below the historical average. In the first three quarters of 2016, it increased at an estimated rate of only 0.5%, relative to the same period of the previous year.

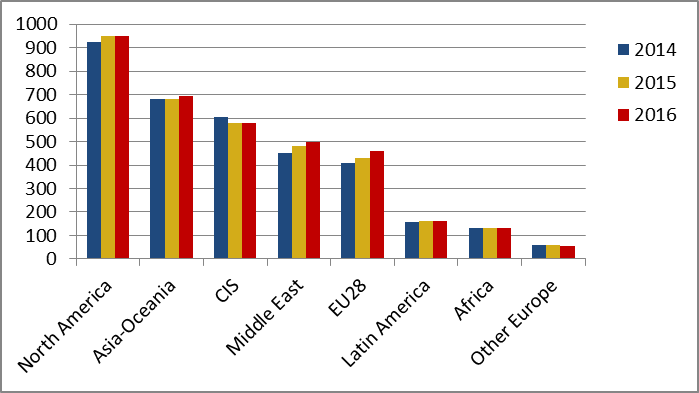

Natural gas developments remained contrasted worldwide. The largest growths in gas demand were recorded in Europe (+6.1%), the Middle East (+3%), India (+9.5%) and China (+8%), contrasting with mixed results in the rest of Asia (-2%), North America (+0.2%), the CIS

(+0.1%) and Latin America (-1.3%).

FIGURE 1 – EVOLUTION OF ACTUAL GAS CONSUMPTION BY GEOGRAPHIC ZONE (BCM)

Source: CEDIGAZ First Estimates

Source: CEDIGAZ First Estimates

Faced with low oil prices and harsh conditions in the upstream sector, global gas production was sluggish in 2016. Cedigaz provisional estimates show a relative stagnation of global natural gas supply in 2016, marking a break after a continued growth of 1.8%/year on average during the five previous years.

FIGURE 2 – TOP-10 NATURAL GAS PRODUCERS (BCM)

Source: CEDIGAZ First Estimates

The international gas trade increased much faster than global gas demand, up 5.5% to 1094 bcm, propelled by both pipeline trade (+ 5%) and LNG flows (+ 6.7%). This difference attests to the growing regional and local imbalances resulting from natural gas shortages in many markets, where production does not keep pace with domestic demand. Fortunately, natural gas markets remained well-supplied in 2016, although the expected LNG surplus did not materialize in 2016 because of delays in project start-ups and technical problems at some LNG trains. Relatively abundant and low-priced LNG supply have opened a window of opportunity for natural gas and LNG, especially in the booming and price-sensitive emerging markets, where LNG has become a natural choice to address the shortfall between gas supply and demand.

The availability of supply should not be an issue in the next five years and a growing part of this is set to be traded via pipeline and LNG to feed markets which suffer from gas deficits. The LNG surplus is set to expand further in 2017, 2018 and 2019. We expect gas markets to take benefit of it. Price developments are more uncertain and depend on many factors, including the level of oil prices, the evolution of environmental regulation, the portion of unutilized LNG capacity, the commercial strategy of Gazprom, economic growth, and the scale of the demand response in price-sensitive emerging markets in a world of excess supply. The European market and US LNG will increasingly act as balancing mechanisms on the global gas market, driving the trend for international spot prices.

For more information: contact@cedigaz.org

Cedigaz is an international association with around 80 members worldwide, created in 1961 by a group of international gas companies and the Institut Français du Pétrole Energies nouvelles (IFPEN). Dedicated to natural gas information, CEDIGAZ collects and analyses worldwide economic information on natural gas, LNG and unconventional gas in an exhaustive and critical way.