China adopted a new gas storage policy in 2018, mandating minimum stock levels for market participants. The government requires gas suppliers, urban gas distributors, and local governments to have storage capacity equal to 10%, 5%, and 3 days of their annual sales/demand. In 2021, the government issued an implementation plan to accelerate the construction of storage capacity (both underground gas storage (UGS) and liquefied natural gas (LNG) reserves). The plan requires that the total gas storage capacity reaches 55 billion cubic meters (bcm) to 60 bcm in 2025, representing around 13% of the expected natural gas demand. In addition, since the global energy crisis, the new watchword has been to “store as much as possible”. These policies have triggered massive development in gas storage, both in UGS and LNG storage tanks.

Underground Gas Storage

Underground Gas Storage: Pillar of Global Energy Security

Highlights from the CEDIGAZ Global Underground Gas Storage 2024 survey

In an era marked by fluctuating energy markets and geopolitical tensions, the importance of underground gas storage (UGS) has never been more pronounced. As the backbone of global gas security, UGS facilities play a critical role in balancing supply and demand, mitigating price volatility, and ensuring a stable energy supply during peak consumption periods. The recent global gas crisis has thrust UGS into the spotlight, prompting accelerated growth and renewed investment in this vital infrastructure.

Accelerated Growth of Underground Gas Storage

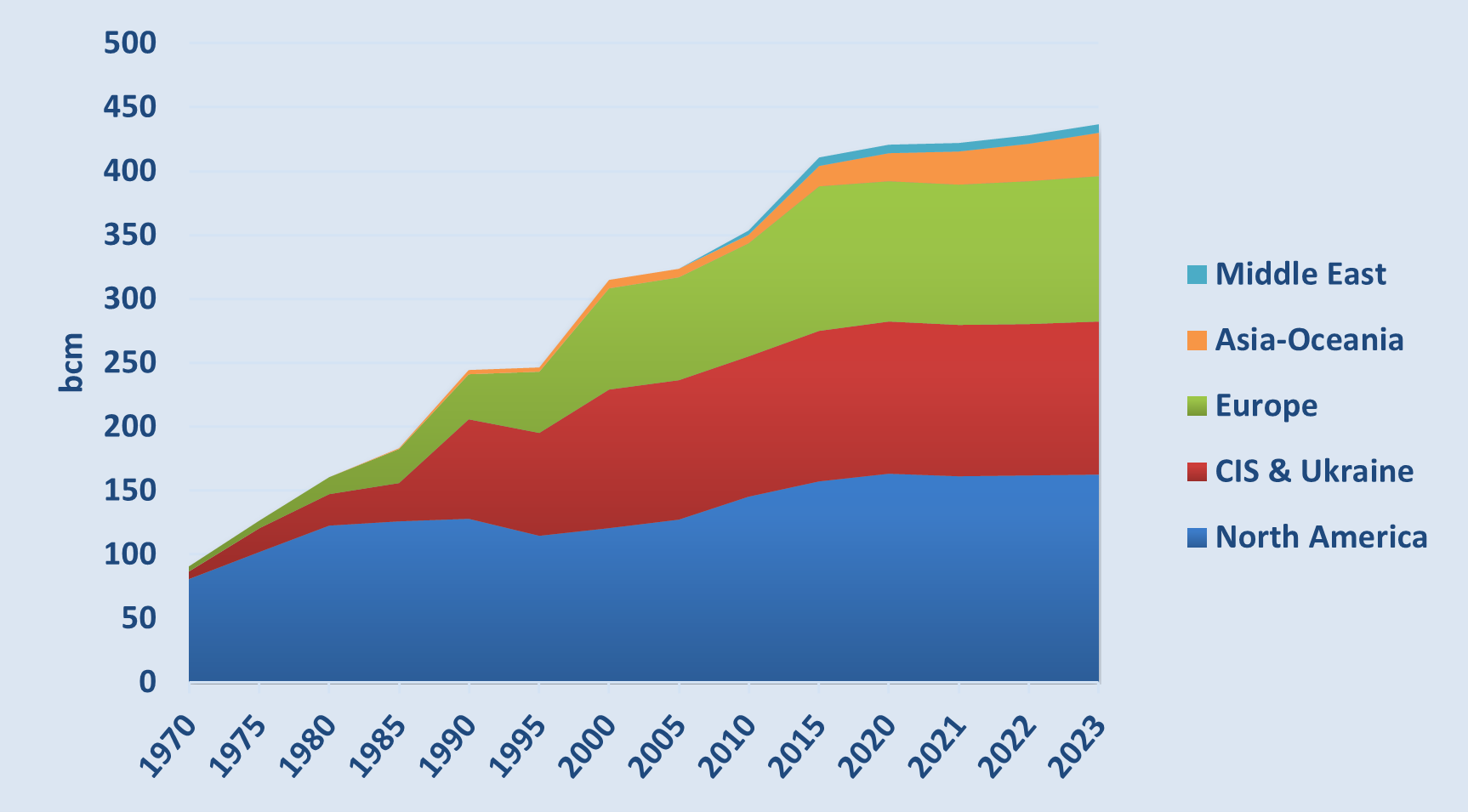

By the end of 2023, the global working gas capacity of UGS reached 437 billion cubic meters (bcm), a 2% year-on-year increase—the largest since 2015. This surge is primarily due to significant capacity expansions in China, with additional contributions from Europe, Kazakhstan, and Canada. The number of operational UGS facilities globally stood at 681, with China commissioning five new facilities and Saudi Arabia adding its first. The global peak withdrawal rate also increased by 1.6% to 7,516 million cubic meters per day (mcm/d).

Evolution of Global Working Gas Capacity (2023-2024)

Source: CEDIGAZ – Country indicators database, UGS database

Underground Gas Storage in the World – 2023 Status

CEDIGAZ 2023 status report on Underground Gas Storage (UGS) worldwide highlights significant developments and shifts in the global gas market.

2022 witnessed a notable increase in UGS capacity, largely driven by the global gas crisis which emphasized the importance of storage for supply security. By the end of 2022, the working gas capacity reached 429 billion cubic meters, a 1.3% rise from the previous year, with significant contributions from China and Europe. The peak withdrawal rate also rose by 1.7%.

The storage market remains concentrated, but China’s UGS sees an accelerating growth

The storage market is largely concentrated in a few countries, with the United States, Russia, Ukraine, Canada, and Germany holding 68% of global capacities. However, there’s a growing focus on expanding storage in rapidly developing markets like China and the Middle East.