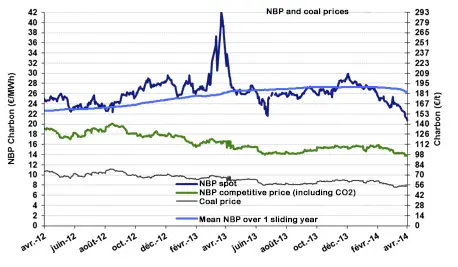

NBP: the downward trend continues

NBP prices are continuing with the downward trend that got under way in early December, and have fallen from €30/MWh (US$11.9/MBtu) on 3 December 2013 to €18.9/MWh (US$7.7/MBtu) on 6 May – a decrease of 37%. The average for the month of April stood at €20.7/MWh (US$8.4/MBtu), 10.8% down on March. The tense situation in Ukraine does therefore not appear to be having any significant effect on NBP – apart from a couple of one-off peaks on 3 March (8.8%, Ukraine placed its military on combat alert) and 7 April (6%, start of fighting in eastern Ukraine). The market context is the reason for this downward trend: 1/ demand is slightly below seasonal norms; 2/ European

NBP prices are continuing with the downward trend that got under way in early December, and have fallen from €30/MWh (US$11.9/MBtu) on 3 December 2013 to €18.9/MWh (US$7.7/MBtu) on 6 May – a decrease of 37%. The average for the month of April stood at €20.7/MWh (US$8.4/MBtu), 10.8% down on March. The tense situation in Ukraine does therefore not appear to be having any significant effect on NBP – apart from a couple of one-off peaks on 3 March (8.8%, Ukraine placed its military on combat alert) and 7 April (6%, start of fighting in eastern Ukraine). The market context is the reason for this downward trend: 1/ demand is slightly below seasonal norms; 2/ European  stocks (which stood at 41.7 Gm3 on 6 May) are the highest they have been at the same period since 2010; 3/ the LNG market is continuing to shrink – Asian prices are at US$14/Mbtu; 4/ there are no significant pressures affecting the oil market (average Brent prices were US$107.5 in March and April). This situation is pushing down listings which are now at around €20/MWh (US$8.1/MBtu) over the summer and €26/MWh (US$10.5/MBtu) for next winter. There is still a great deal of uncertainty over the results of the negotiations that got under way in early May between Russia and Ukraine in relation to the delivery price of Russian gas and payment terms (prepayment in June has been mentioned). Disruptions to the gas trade with Ukraine and even all of Europe are possible in June. This would doubtless affect prices.

stocks (which stood at 41.7 Gm3 on 6 May) are the highest they have been at the same period since 2010; 3/ the LNG market is continuing to shrink – Asian prices are at US$14/Mbtu; 4/ there are no significant pressures affecting the oil market (average Brent prices were US$107.5 in March and April). This situation is pushing down listings which are now at around €20/MWh (US$8.1/MBtu) over the summer and €26/MWh (US$10.5/MBtu) for next winter. There is still a great deal of uncertainty over the results of the negotiations that got under way in early May between Russia and Ukraine in relation to the delivery price of Russian gas and payment terms (prepayment in June has been mentioned). Disruptions to the gas trade with Ukraine and even all of Europe are possible in June. This would doubtless affect prices.