NBP: drop in July, but market concerns

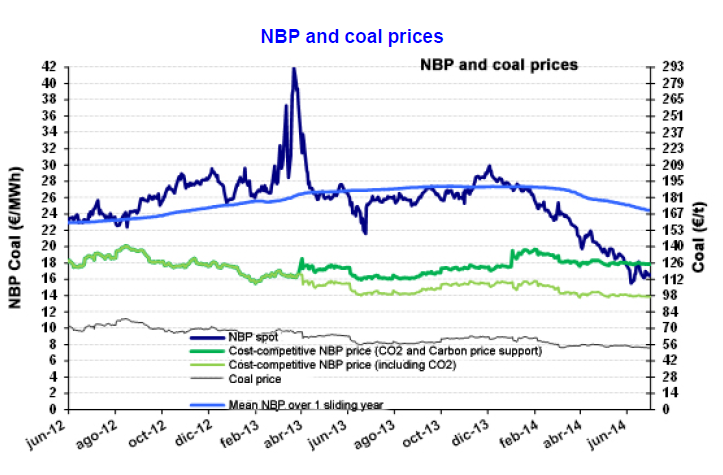

The average NBP price for July was €16.2/MWh ($6.4/MBtu), 3.6% less than the previous month and 37% less than the same month last year. The NBP was marked by relatively high volatility, around +/-10%. It fell to a low of €14.8/MWh ($5.9/MBtu) on 11 July before climbing to nearly €18/MWh ($7.0/MBtu) on 28 July. This increase coincided with rising tensions between Russia and the Western countries, with stiffer sanctions imposed by the US on 16 July and then by the Europeans on 28 July. However, it should be noted that pressure remains moderate for now. In fact, the NBP is significantly lower than it was during the past three summers (€21 to €26/MWh on average).

The average NBP price for July was €16.2/MWh ($6.4/MBtu), 3.6% less than the previous month and 37% less than the same month last year. The NBP was marked by relatively high volatility, around +/-10%. It fell to a low of €14.8/MWh ($5.9/MBtu) on 11 July before climbing to nearly €18/MWh ($7.0/MBtu) on 28 July. This increase coincided with rising tensions between Russia and the Western countries, with stiffer sanctions imposed by the US on 16 July and then by the Europeans on 28 July. However, it should be noted that pressure remains moderate for now. In fact, the NBP is significantly lower than it was during the past three summers (€21 to €26/MWh on average).

Future trends remain very uncertain given the many possible scenarios regarding Ukraine (whether or not gas transit via Ukraine will be impacted, Russian exports disrupted, etc.). Relative to the beginning of July, the market is gradually adjusting the trends for the coming months upwards, particularly for the winter. Future prices are now around €27/MWh from December to next March.