NBP: going down

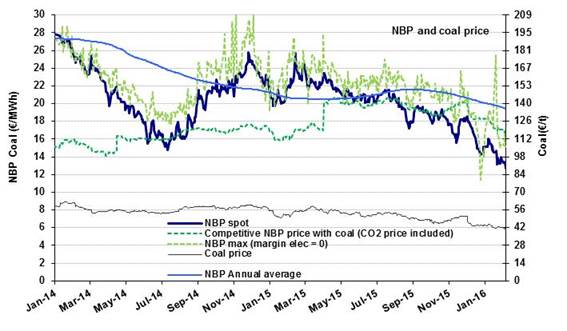

The NBP fell from €22/MWh ($7/MBtu) in March 2015 to €14.5/MWh ($4.6/MBtu) in January 2016, which represents a decline of 35%. This decrease is consistent with the general trend in energy prices over the same period: coal was down by 25%, oil by 45% and the average price of Japanese LNG by 35%.

The NBP fell from €22/MWh ($7/MBtu) in March 2015 to €14.5/MWh ($4.6/MBtu) in January 2016, which represents a decline of 35%. This decrease is consistent with the general trend in energy prices over the same period: coal was down by 25%, oil by 45% and the average price of Japanese LNG by 35%.

The NBP stood at about €13.2/MWh ($4.2/MBtu) at the beginning of February and is expected to keep sliding. The futures markets anticipate a price of €12.2-12.4/MWh ($4.0-4.1/MBtu) for next summer. These forecasts are in line not only with the decrease in the average six-month oil price, which will also hit bottom next summer, but also with expected coal price trends. The average NBP for 2016 is now pegged at €13.2/MWh ($4.3/MBtu), i.e. 34% lower than in 2015.