CEDIGAZ, the International Association for Natural Gas, has just released its « Medium and Long Term Natural Gas Outlook 2018 ». In CEDIGAZ Reference Scenario, which incorporates national energy plans and INDC commitments, natural gas demand will grow by 1.4%/year between 2016 and 2040 and will play a growing role in the energy mix at the expense of the other fossil fuels. The gradual shift from coal and oil to natural gas and renewables helps reduce the carbon intensity of the energy system as electrification and decarbonisation accelerate over the projection period. The expansion of natural gas markets is supported by both abundant and competitive conventional and unconventional resources, as well as a very rapid growth of spot and flexible LNG trade.

Cedigaz - Page 28

Global LNG trade continues strong momentum in Q1 2018

The global LNG trade in Q1 2018 sustained the growth momentum which was seen in 2017 as total LNG net imports grew by 9.6% (+6.89 MT YoY) to reach 78.7 MT. This strong growth was bolstered mainly by China (+4.83 MT YoY) and South Korea (+1.60 MT YoY) in North East Asia as well as India (+ 1.36 MT YoY) in South Asia. Bangladesh will also add to the regional demand marginally in 2018 as it started importing LNG in April this year. The Q1 2018 growth in China (+62% YoY) which resulted from coal to gas switching is adequate to maintain a 13% annual growth in 2018 even if the April-Dec’18 demand in China holds flat compared to the year earlier. South Korea surpassed China marginally in Q1 2018 in terms of net LNG imports. Domestic gas demand from the power sector in South Korea surged as 12 nuclear power units were offline. In India, LNG imports grew as a result of higher gas demand from the fertilizer sector and city gas distribution.

Quarterly report on Natural gas prices (Q1 2018)

Global trends

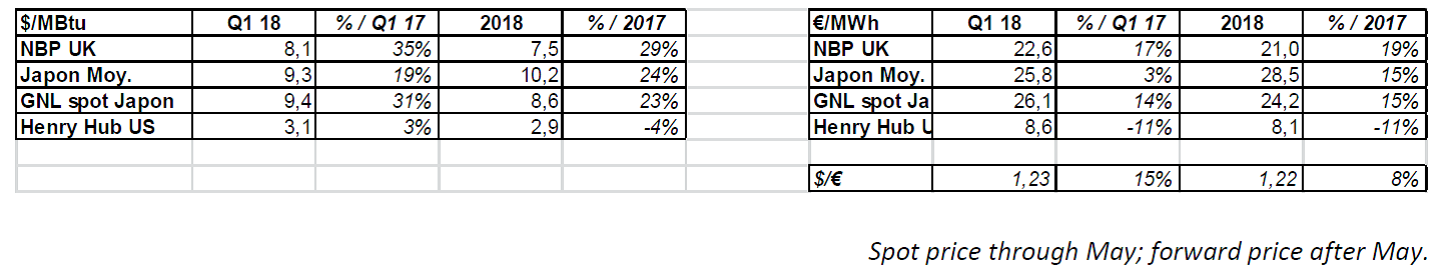

Gas prices rose in Q1, mainly owing to a harsh winter (Fig. 1). Since then, they have declined, as is usually the case in spring and summer. The gas prices in Europe and Japan should be higher this year than last year, due to the uptrend in the oil price and its impact on Asian oil-indexed contracts and winter spot prices. For this summer, the increase in the CO2 price in Europe (+110% in one year) has created a higher reference for the gas price. These trends do not pertain to the U.S. market, where the price has tended to remain stable or fall.

Gas price, by quarter: U.K., Japan and the U.S. ($/MBtu and €/MWh)

|

|

Spot price ($/MBtu and €/MWh)