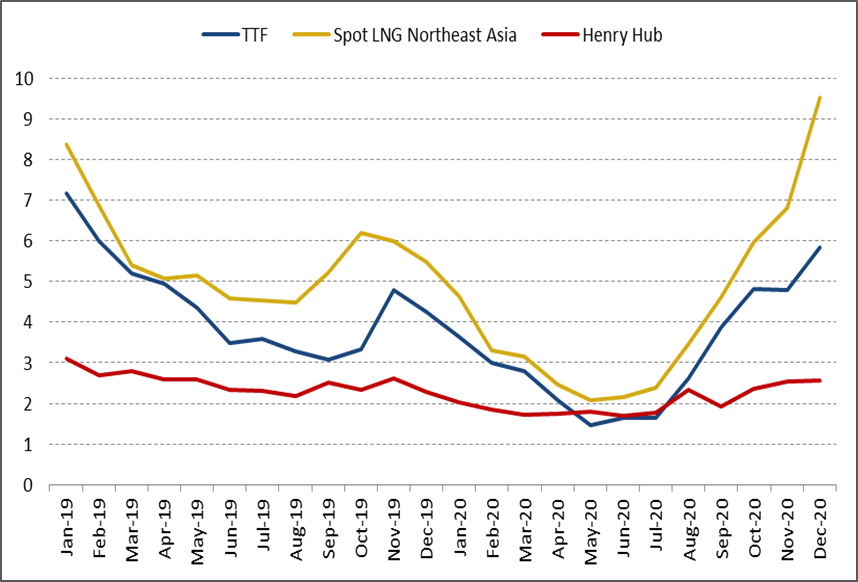

- In the last quarter 2020, international spot prices continued their upward momentum to exceed last year’s price levels. Asian spot prices in particular rose impressively to peak at a six-year high of 12$/MBtu at the end of the year.

- This recent and unexpected spike in Asia was fuelled by Chinese LNG demand, which is rising amid a colder than average winter, and also healthy weather-driven gas demand in other parts of Northeast Asia. On the supply side, diverse LNG plants’ outages limited available LNG supplies. Tight shipping and exorbitant shipping rates also tightened supplies.

- In this context, more and more LNG cargoes were redirected from the Atlantic Basin to Asia. In December, the price spread between the US and Asia reached its highest in two years. The Asian spot price premium versus TTF also peaked to more than 3.5$/MBtu.

- US LNG exports bounced back. They reached their highest monthly level at around 8-8.5 bcm in November and December, against a monthly average of 3 bcm during summer. Qatar, which benefits from flexible and low cost supply, also witnesses good adaptability by diverting its LNG exports from Europe to Asia.

- In Europe, the TTF surged in December as LNG supply tightened while gas demand picked up after falling in November. European gas demand in the last quarter was less affected by the COVID-19 and lockdown measures than during last spring.

- During the last quarter, oil-indexed prices in Asia increased slightly, starting to reflect the mid-year recovery of oil prices with at least a three-month lag. For the first time since 2018, oil-indexed prices were at a discount to spot prices in Asia.

- For the whole year 2020, spot prices in Europe and Asia declined by respectively 28% and 25% from 2019. The ever-increasing volatility in prices reflects a context of deep uncertainty, while paper trading and hedging operations kept growing.

- The forward prices indicate steep backwardation in the next few months, while oil-indexed prices are expected to keep rising.

- In 2020, the hyper-volatility of gas prices which has never been recorded before raises the question about the growing role of some determinants of prices versus some other ones and to which extent misalignments from economic fundamentals can occur.

Evolution of international spot prices

For the last quarter 2020, the TTF and the Northeast Asian spot price were respectively 25% and 26% higher than in the last quarter of 2019. For the month of December only, the Asian spot price was 75% above that in 2019, while the TTF was 38% up annually.

International spot prices extended their bullish rally in October, respectively up 24 to 27% in Europe and Asia from September. In November, the TTF price remained relatively unchanged from October but the Northeast Asian spot LNG price rose further and expanded its premium to the average European gas price. In December, Asian spot prices rocketed to reach six-year high at the end of the month. This price explosion was triggered by strong winter demand and urgent buying requirements from importers and traders across Northeast Asia. Other factors were at play: LNG supply outages in many countries (Australia, Malaysia, Indonesia, Qatar, Norway), strong winter restocking demand, tight shipping and exploding LNG charter rates. The Northeast Asian LNG spot price ended the year 2020 with a record breaking bull run with Jan-21 LNG prices assessed at 15$/MBtu. Recently, Asian spot prices extended gains reflecting urgent short-covering demand amidst tightness in supplies, thus opening the widest premium to European spot prices on record.

The US Henry Hub price was 3% higher in the last quarter. Some of the key drivers of this hike were the strong growth of US LNG exports.

Figure 1: Evolution of monthly international spot prices ($/MBtu)

Source: Reuters, Argus

Evolution of oil-indexed contract prices

In the last quarter, the oil-indexed LNG contract price increased slightly, after a steady fall from the first quarter. Due to the several month lag, the mid-year recovery in oil prices started to be reflected at the end of the year. Oil-indexed prices inched up to just above 6$/MBtu in December. Because of the unexpected spike in Asia, the oil-linked premium to Hub price turned negative. In December, the average Japan oil-indexed LNG price was 33% below the spot level. This reversal potentially prompts Northeast Asian buyers to seek incremental long term volumes.

The Japan average LNG import price is expected down 22% to 7.9$/MBtu for the full year 2020. The year 2020 has showed a divergence between oil prices and spot prices, this latter surpassing crude oil parity towards the end of the year.

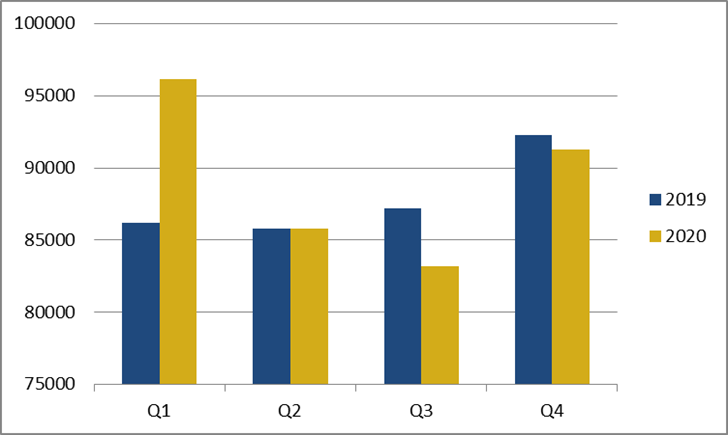

Recent developments on the global LNG market

In the last quarter, global LNG demand slid again in the continuity of the previous six-months, with the largest reductions recorded in November and December, driven by Europe. The LNG trade massively shifted to Asia, which remains by far a more profitable destination. Strong northeast Asian LNG demand drew Atlantic-basin cargoes away from Europe, with the inter-basin arbitrage widely open throughout the quarter. For the whole year 2020, LNG trade is expected to post a modest growth despite the Covid-19 pandemic and the induced contraction in economic activity.

In this context, it is estimated that LNG imports into the EU28 fell by more than 30% in the last quarter compared to the previous year, while they increased by almost 20% in China, the most dynamic market.

Figure 2: Evolution of global LNG supply (000 t)

Source: Cedigaz provisional estimates

Annual review

In 2020, average international spot prices were lower than in 2019: down 28% to 3.2$/MBtu for the TTF, down 25% to 4.2 $/MBtu for the Asian spot LNG price and down 20% to 2$/MBtu for the Henry Hub, the lowest US annual average price in decades.

The year 2020 shows an ever-recorded hyper-volatility in spot gas prices, which was even more important than that of oil prices. The first half of the year saw a period of convergence of international spot prices falling towards record lows. The second half in contrast rather displayed a gradual divergence with price spreads breaking all-time highs at the end of December.

Short term prospects

A rally in Asian prices since the end of November should continue to provide incentive to divert Atlantic basin supply away from Europe for deliveries in Asia in early 2021.

Thus, European LNG imports are expected to stay weak in January and February because of buoyant weather-driven demand in Asia combined with needs for LNG restocking.

The Asian price forward curve indicates a steep backwardation after a peak in February, which could left the inter-basin arbitrage tighter and prompt more US deliveries to Europe from March, especially in a context of high charter rates.

The oil-indexed Japan LNG price is expected to rise gradually to reach a peak of 8$/MBtu at the end of June 2021, while the Asian spot LNG price is assessed at 6.5$/MBtu at the beginning of the summer, according to forward contracts as of 8 January 2021.

Armelle Lecarpentier, Chief Economist, CEDIGAZ

Cedigaz (International Center for Natural Gas Information) is an international association with members all over the world, created in 1961 by a group of international gas companies and IFP Energies nouvelles (IFPEN). Dedicated to natural gas information, CEDIGAZ collects and analyses worldwide economic information on natural gas, LNG and unconventional gas in an exhaustive and critical way.